SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – In a survey conducted on the Rappler and eCompareMo websites, the majority of those who have applied for credit cards said they got rejected.

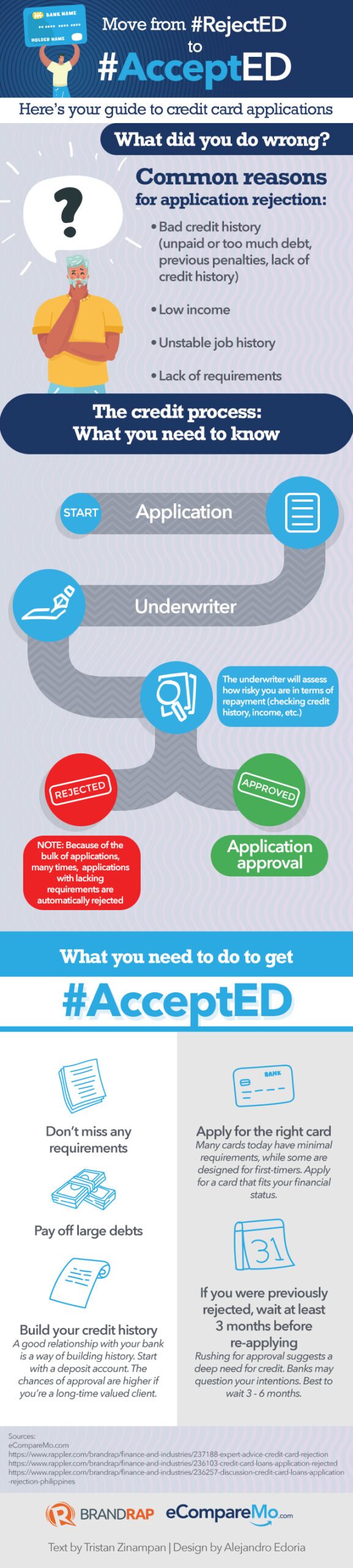

According to experts, many rejections are caused by a lack of education. For example, many continue to submit applications with lacking requirements in hopes that banks will be understanding. What they don’t know is, many banks automatically reject applications with incomplete requirements.

As Stephanie Chung, CEO and co-founder of eCompareMo, put it, “you have to educate yourself not to be the victim. Once you start with yourself and gain that awareness you need to learn, then that’s already empowerment in itself.”

Here’s what you need to know about why your previous applications were rejected and what you must do to get #AcceptED.

Learning the basics of personal finance – from budgeting to the ins and outs of the credit process – is important to move forward in one’s financial journey.

Once you get the hang of things, not only will you be able to maintain your good credit standing, but you will also get the most out of the wide range of financial services available in the market. – Rappler.com

eCompareMo provides customers with online comparison tools that help them find credit card and loan products they’ll most likely get approved for. Try it out yourself by clicking here!

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.