SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines — Worldwide, countries have made the transition to a cashless society. Is the Philippines keeping up?

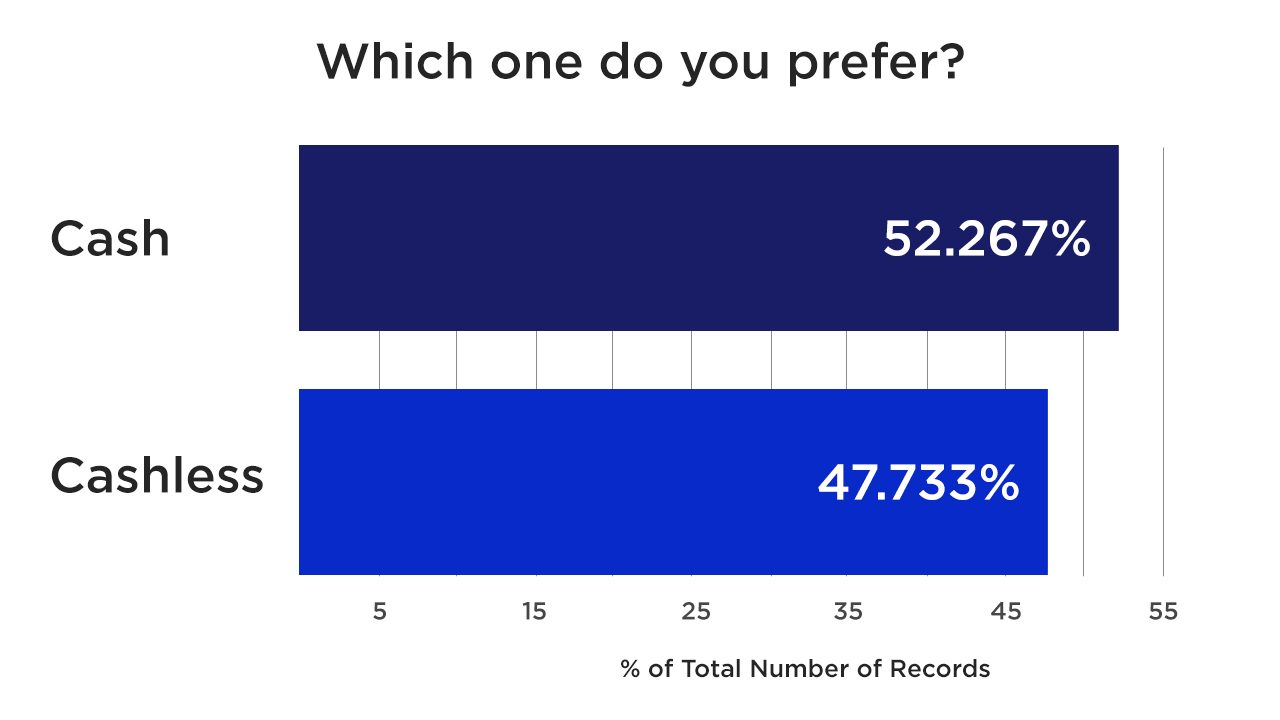

Locally, cashless behavior is steadily growing popular. In a survey by Rappler in partnership with Visa, it was found that 55% of Filipinos use debit and credit cards, prepaid cards, and other digital payments. But in terms of preference, cash remains king — albeit by a narrow margin.

According to the survey, 52% of Filipinos would pick cash over cashless transactions.

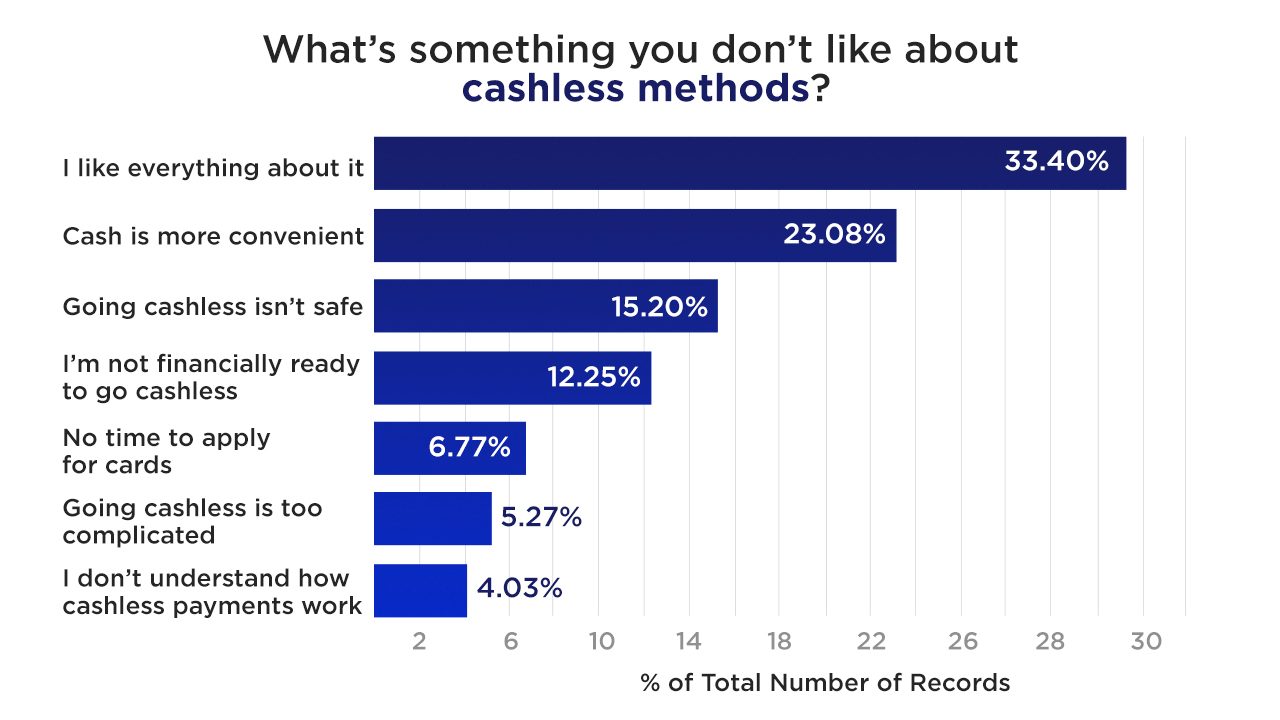

Top reasons are: cash is easier, card payments are unsafe, or they’re not financially ready.

Got similar concerns? Bianca Gonzalez, host, author of “Paano Ba ‘To?!,” and Visa ambassador, sheds some light on going cashless below.

How is going cashless easier than just pulling out cash?

Going cashless is so much more convenient than having to deal with cash. I’ve experienced times na napakahaba ng pila sa ATM, especially during payday and weekends. Or worse, you go to several ATM machines tapos offline lahat.

Using a Visa card is more convenient because you won’t have to worry if you’re carrying enough cash. You also don’t have to deal with dirty bills and heavy coins. When you are a mom, issue ito!

Bonus: So many banks give rewards points when you go cashless. You can get discounts on gas, grocery, or fashion items! You get more out of the money that you spend.

Is going cashless safe?

I find going cashless very safe because of the new EMV chip technology, which ensures transactions are safe and protected against fraudulent transactions.

I don’t have to worry where my money’s going because I can see it all online, real time. I can just go online or log on to the bank’s app to track my expenses — as opposed to collecting paper receipts, re-writing them, and adding everything up on paper.

How do I know if I’m financially ready to go cashless?

I think anyone, starting from college students to young Pinoy workers, is eligible. When you start handling your own money, you can deal with going cashless.

If you’re just starting, I would recommend a debit card. The debit card basically works like an ATM card in that you can only spend the amount that is in the card — but without having to line up and deal with bulky cash.

I used to think that having a card would cause me to overspend. But if you aren’t disciplined enough to keep track of your expenses, you’ll end up overspending whether you use cards or cash.

Where can I go cashless?

Going cashless isn’t just for online purchases. I go cashless to gas up, buy groceries, go shopping, buy coffee, eat out in restaurants, almost everywhere!

I also prefer to go cashless when traveling. For the past few years I just carry a bit of cash for safety, then all my transactions would be through my Visa card. A lot of the countries we travel to don’t prefer cash transactions anymore. Plus at the counter, you can choose whether you want to pay in the currency of the country you are in or in Philippine pesos.

What other cashless options do I have?

I’m excited for Visa payWave to roll out in more stores, especially groceries and restaurants. Visa payWave makes paying with a card so simple and fast — all you have to do is tap your card on to the machine, and that’s it! No more old-school scanning or swiping. Plus you have control of your card because you don’t have to hand it to the cashier, you hold it yourself.

Other tips for good money habits?

We’re so lucky to have more investment options and apps to track our expenses. Be curious, ask around, and research online because there are so many options available now on how we can be smarter with our money.

No excuses

Going cashless can only take you so far in terms of convenience. You still need to be responsible when handling your own money.

You may not see physical cash, but with the technology available, you can easily track where your money’s going!

Do you have other questions about going cashless? — Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.