SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

As a professional or a self-employed individual, how do I apply for a taxpayer identification number (TIN) with the Bureau of Internal Revenue (BIR)? I also heard about the 8% tax for self-employed individuals. Will I qualify?

Under BIR Revenue Memorandum Order No. 19-2018, the requirements to register as a self-employed individual, professional, or mixed income earner are:

- BIR Form No. 1901

- Government-issued ID showing the applicant’s name, address, and birthdate

- Photocopy of Mayor’s Business Permit/Professional Tax Receipt or Occupational Tax Receipt/Department of Trade and Industry Certificate

- Proof of Payment of Registration Fee (if with existing TIN or applicable after TIN issuance)

- BIR Form No. 1906

- Final and clear sample of Principal Receipts/Invoices

The following documents shall also be submitted if applicable:

- Special Power of Attorney and ID of authorized person, in case of authorized representative who will transact with the Bureau

- Franchise Documents (e.g. Certificate of Public Convenience) (for Common Carrier)

- Photocopy of the Trust Agreement (for Trusts)

- Photocopy of the Death Certificate of the deceased (for estate under judicial settlement)

- Certificate of Authority, if Barangay Micro Business Enterprises (BMBE) registered entity

- Proof of Registration/Permit to Operate from the Board of Investments, Philippine Economic Zone Authority, Bases Conversion and Development Authority, or Subic Bay Metropolitan Authority

Self-employed and professionals (SEPs) who are not VAT-registered can also avail of an 8% income tax based on gross sales or gross receipts, provided it is indicated in the first tax return for the year. Mixed income earners may also avail of the 8% rate, but only on income earned through business or practice of profession. A mixed income earner availing of the 8% will pay the graduated personal income tax rates on their compensation income.

What are the new tax rates for SEPs? What about mixed income earners?

SEPs and mixed income earners both pay personal income tax, which has recently been amended by the Tax Reform for Acceleration and Inclusion (TRAIN) law. The new tax rates are:

What are the taxes that I have to pay?

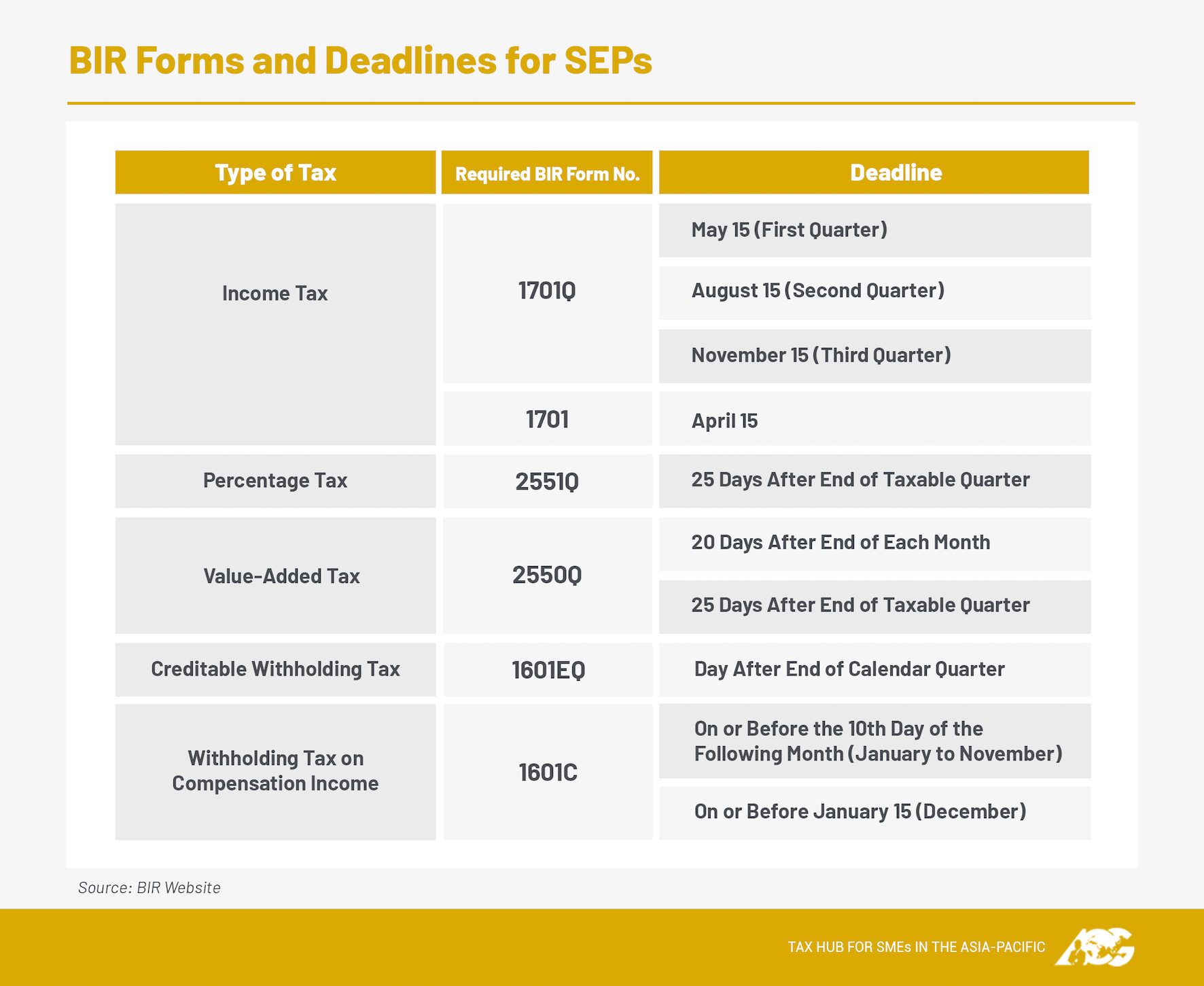

The most common types of taxes that an SEP needs to pay are income taxes and business tax. The income tax, as earlier mentioned, can either be for the graduated rates or the optional 8%. SEPs need to file Quarterly Income Tax returns (BIR Form No. 1701Q) every May 15 (1st quarter), August 15 (2nd quarter), and November 15 (3rd quarter). They will also need to file the Annual Income Tax returns (BIR Form No. 1701) every April 15 of each year.

For the business tax, SEPs can either pay value-added tax or percentage tax. Under TRAIN, the threshold for VAT registration has been increased to P3 million in gross annual sales. Those earning below the VAT threshold can still choose to pay VAT instead of the percentage tax, but note that taxpayers who are not VAT-registered are the only ones that can avail of the optional 8% tax.

If the taxpayer has employees, they will have to remit the withholding taxes on compensation income as well.

With all the dates that SEPs need to remember, it is important to have a calendar of deadlines at hand. The TaxWhizPH app provides reminders of approaching deadlines, and will even be able to automatically generate your returns for you. Late filing of returns will already cause an expensive penalty that could easily have been avoided. Through the app, taxpayers will be able to file and pay their taxes while on the go. Watch the features of the TaxWhizPH app here. You can also visit app.acg.ph and subscribe for free.

If you have more questions about taxes, just send them through our Facebook page, The Philippine Tax Whiz. The Asian Consulting Group’s Tax Whiz Academy can also conduct an exclusive tax coaching session if you want a more in-depth discussion about taxes, compliance, and BIR issuances. To learn more about Exclusive Tax Coaching, email us at consult@acg.ph or call us at 6227720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.