SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I own a sari-sari store registered as a sole proprietorship. Will I be affected by the Tax Reform for Attracting Better and Higher Quality Opportunities (Trabaho) bill? What does the bill actually contain?

Not directly. Taxation on self-employed individuals has already been reformed by the Tax Reform for Acceleration and Inclusion (TRAIN) law. As the second package of the Comprehensive Tax Reform Program (CTRP), Trabaho is focused mainly on corporations. In fact, only the administrative proposals will affect taxpayers who do not own or are part of corporations.

The major aspects of Trabaho are the lowering of corporate income tax, rationalization of incentives, imposition of offsetting measures, and the implementation of administrative reforms.

I am an entrepreneur planning to start a small corporation. If Trabaho is passed into law, what will be the rate of corporate income tax?

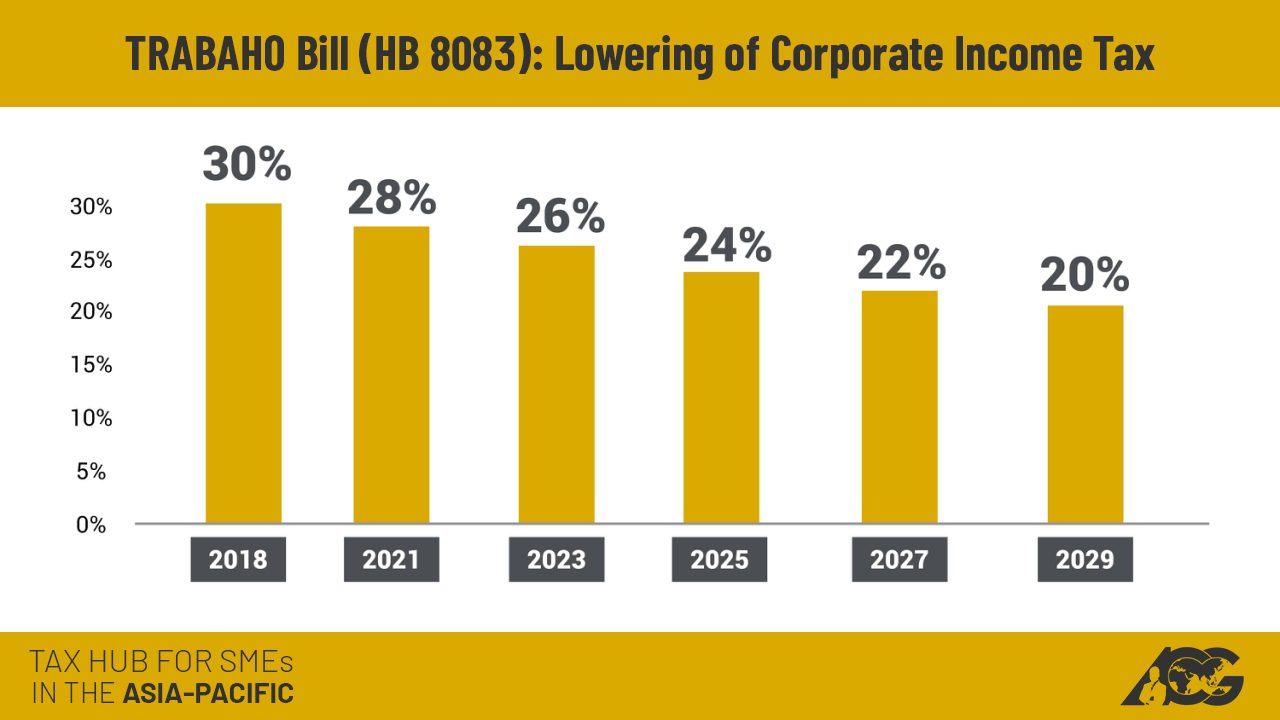

Under Trabaho, the corporate income tax would still be 30% until 2020. On January 1, 2021, the corporate income tax would be lowered to 28%. From there, the reduction will be 2% every two years. From 2029 onwards, the corporate income tax will stay at 20%.

There have been plenty of protests against the Trabaho bill because of the rationalization of incentives. Will all incentives be removed under Trabaho?

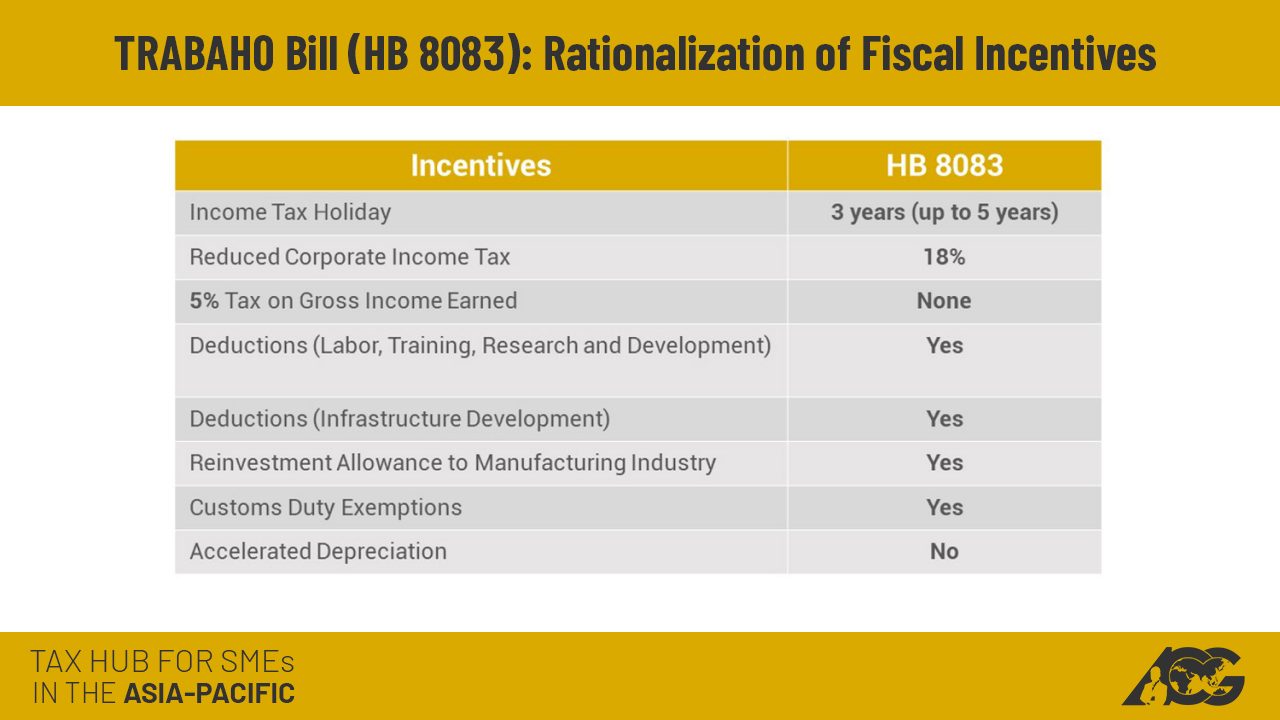

No. The rationalization of incentives simply means that incentives will be more targeted and performance-based. It does not mean that there will be no incentives. In fact, a provision in Trabaho specifically states that those currently receiving incentives will still retain those incentives.

Under the new incentives system, the Fiscal Incentives Review Board will authorize the issuance of incentives.

Does this mean tax rates will be increased for others? Will it affect prices like in TRAIN?

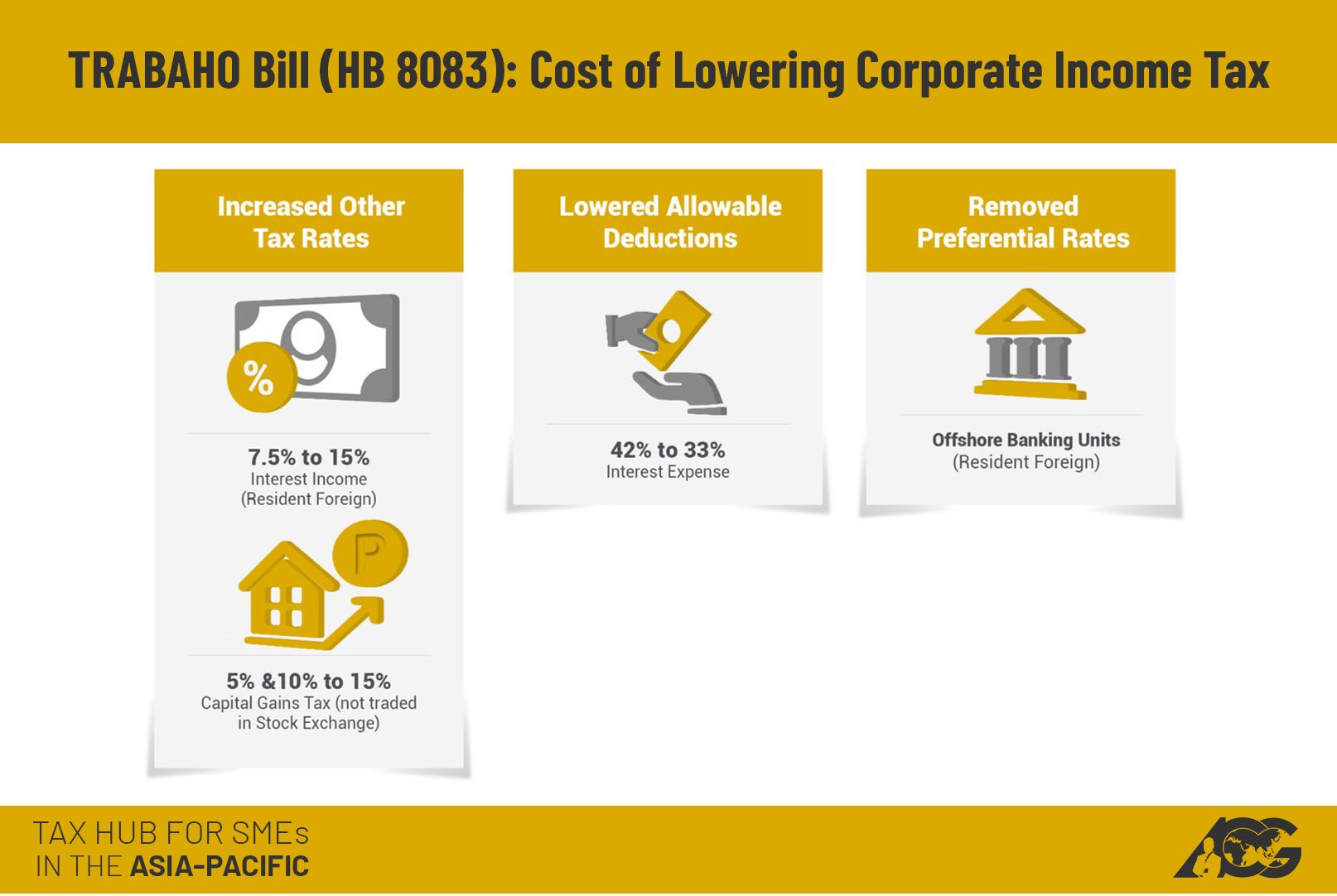

It will increase other tax rates, yes, but it will not affect consumer prices. In fact, the offsetting measures proposed by Trabaho are fewer than those proposed under its earlier versions.

The increased rates will be on the tax on interest income and capital gains tax of resident foreign corporations, both raised to 15%. The allowable deduction for interest expense has been decreased from 42% to 33% and offshore banking units will lose their preferred tax rate of 15%.

Moreover, while optional standard deductions are retained at 40%, only those classified as micro, small, and medium enterprises will be able to avail of the deduction.

I remember that the goal of tax reform is to make paying taxes simpler, fairer, and more efficient. Does Trabaho contribute to that goal?

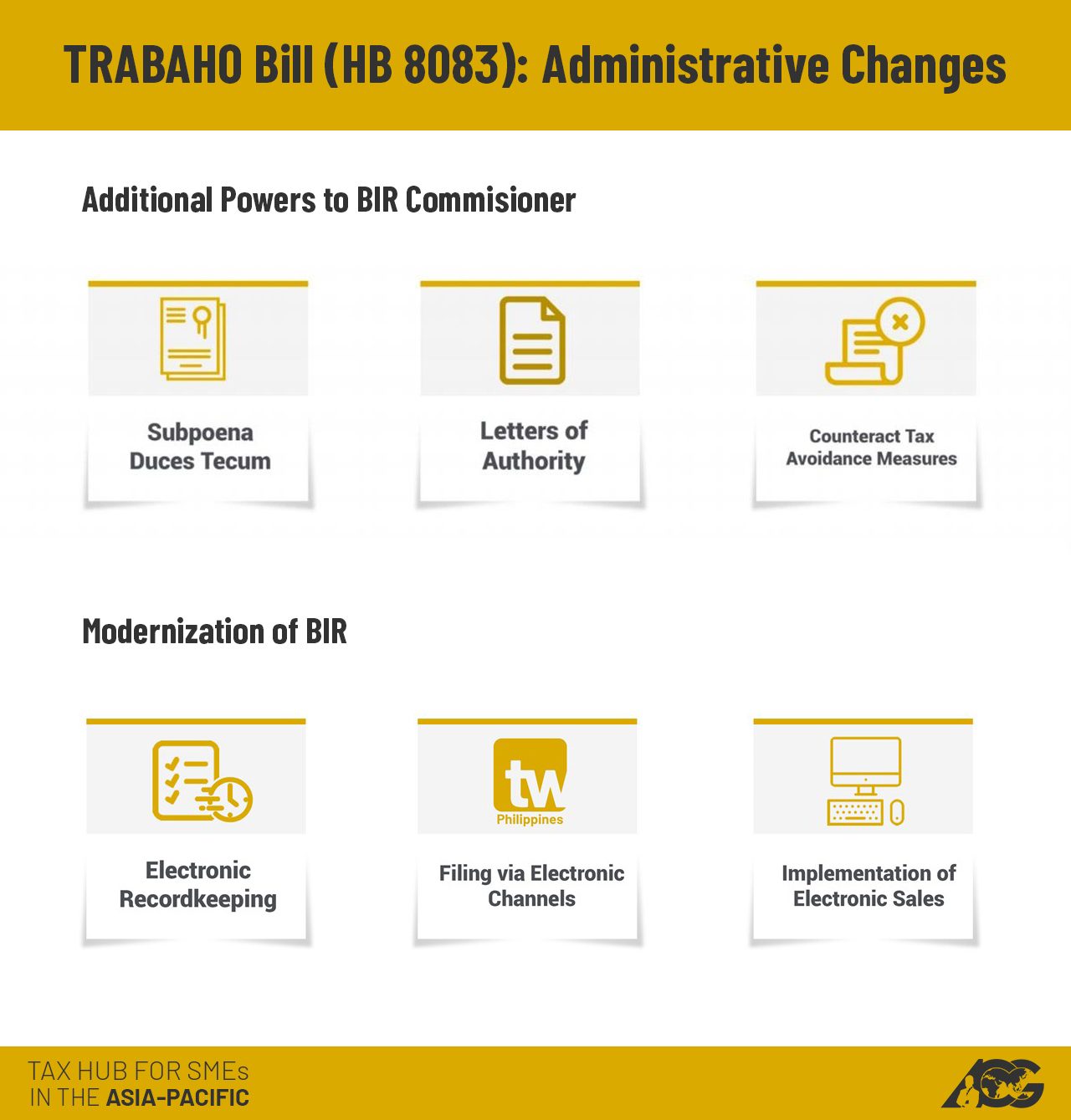

Yes. Under Trabaho, the Bureau of Internal Revenue (BIR) commissioner will have additional functions that would help in running after tax evaders. Most important among these new provisions is the authorization of the commissioner to allocate income and deductions to counteract tax avoidance measures.

In addition, it also has provisions that authorize the BIR to accept electronic records of receipts and sales reports as well as implement an electronic sales reporting system and filing via electronic channels.

These changes to the tax system bring opportunities for businesses to take advantage of. Learning about tax reform is important not only to avoid fines and penalties, but also to learn of new ways of saving on taxes without breaking the law. The Tax Whiz Academy of the Asian Consulting Group offers TRAIN and tax seminars for business organizations and associations, Exclusive Tax Coaching (ETC) for startups and small businesses, and Executive Tax Briefing (ETB) for business owners themselves. To learn more, email us at consult@acg.ph or call us at 6227720.

For more questions about the ongoing tax reform or just general tax compliance, just visit our Facebook page, The Philippine Tax Whiz, and follow the instructions so that we can answer your questions. Alternatively, you can also send your questions via Twitter through @AskTheTaxWhiz or use the hashtag #AskTheTaxWhiz. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.