SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

For the sake of tax compliance, are drivers of ride-hailing companies considered employees or self-employed taxpayers?

Drivers and operators commonly referred to as “partners” of a transportation network company (TNC) are considered self-employed taxpayers. According to Revenue Memorandum Circular (RMC) No. 70-2015, which prescribes the tax treatment of persons engaged in land transportation, they are required to register using BIR Form No. 1901 which refers to the Application for Registration for Self-Employed and Mixed Income Individuals, Estates, and Trusts.

RMC No. 70-2015 further prescribes that taxpayers already registered as compensation income earners need to apply using the same BIR form.

As such, partners of a TNC are required to file their tax returns and consequently pay the tax dues monthly, quarterly, or annually, whichever is applicable.

As a TNC driver earning less than the value-added tax (VAT) threshold, am I required to pay percentage tax? How is this different from common carriers tax?

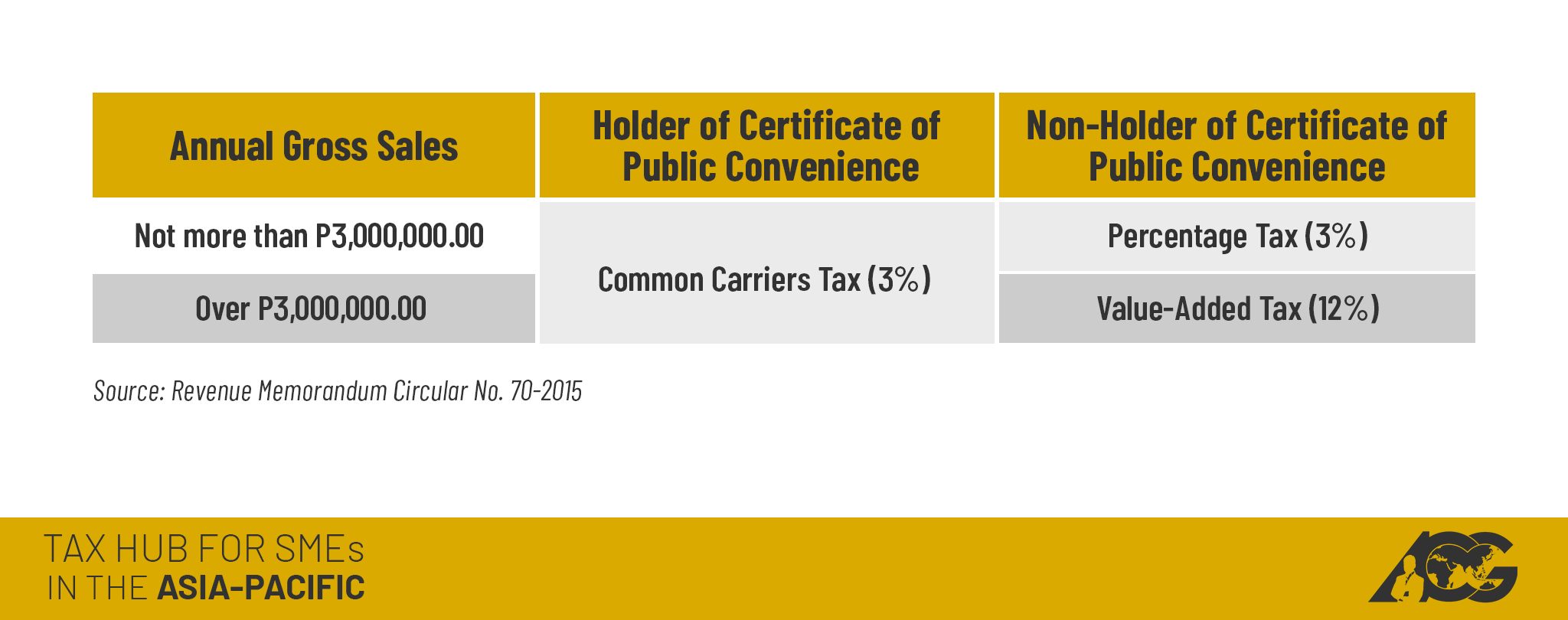

Like percentage tax, the common carriers tax is also equivalent to 3% of the taxpayer’s quarterly gross receipts. It will also be paid using the same BIR form. However, the main difference between the two is that the 3% percentage tax is only available for persons with annual gross sales of not more than P3 million. If the taxpayer exceeds the threshold, they must pay 12% VAT instead.

On the other hand, persons paying the common carriers tax are exempt from VAT, regardless of their annual gross sales.

The RMC also clarifies that, for the purpose of issuing receipts, taxpayers availing of the common carriers tax should issue non-VAT receipts.

However, to be qualified for the common carriers tax, the operator or driver needs to be the holder of a Certificate of Public Convenience. Mere accreditation from the Land Transportation Franchising and Regulatory Board does not qualify.

The different taxes that need to be paid require different forms, with different deadlines. The sheer number could be overwhelming to taxpayers, but avoiding taxes is not the answer. Without proper understanding, it may even be costlier and more stressful later if the Bureau of Internal Revenue imposes hefty penalties.

As such, aside from reading this article, you may wish to learn more from the experts. The Tax Whiz Academy of the Asian Consulting Group offers regular tax reform or tax seminars to business organizations and associations, Exclusive Tax Coaching (ETC) for startups, and Executive Tax Briefing (ETB) for CEOs and businessmen. If interested, email us at consult@acg.ph or call 6227720. You may also visit our website at www.acg.ph.

For more tax-related questions, you can reach us via Twitter through @AskTheTaxWhiz or you can visit our Facebook page, The Philippine Tax Whiz, and leave your queries. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.