SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I’m a local manufacturer of garments and I’m planning on exporting them. I read that importers are required to pay value-added tax (VAT) even if they are below the threshold. Are exporters similar? Have there also been any changes under the Tax Reform for Acceleration and Inclusion (TRAIN) law?

Unlike importers, there is no fixed VAT on exported goods and it is still dependent on annual gross sales. Exporters are only subject to VAT if they exceed the P3-million threshold.

However, for those who are required to pay VAT, there have been changes under the TRAIN law.

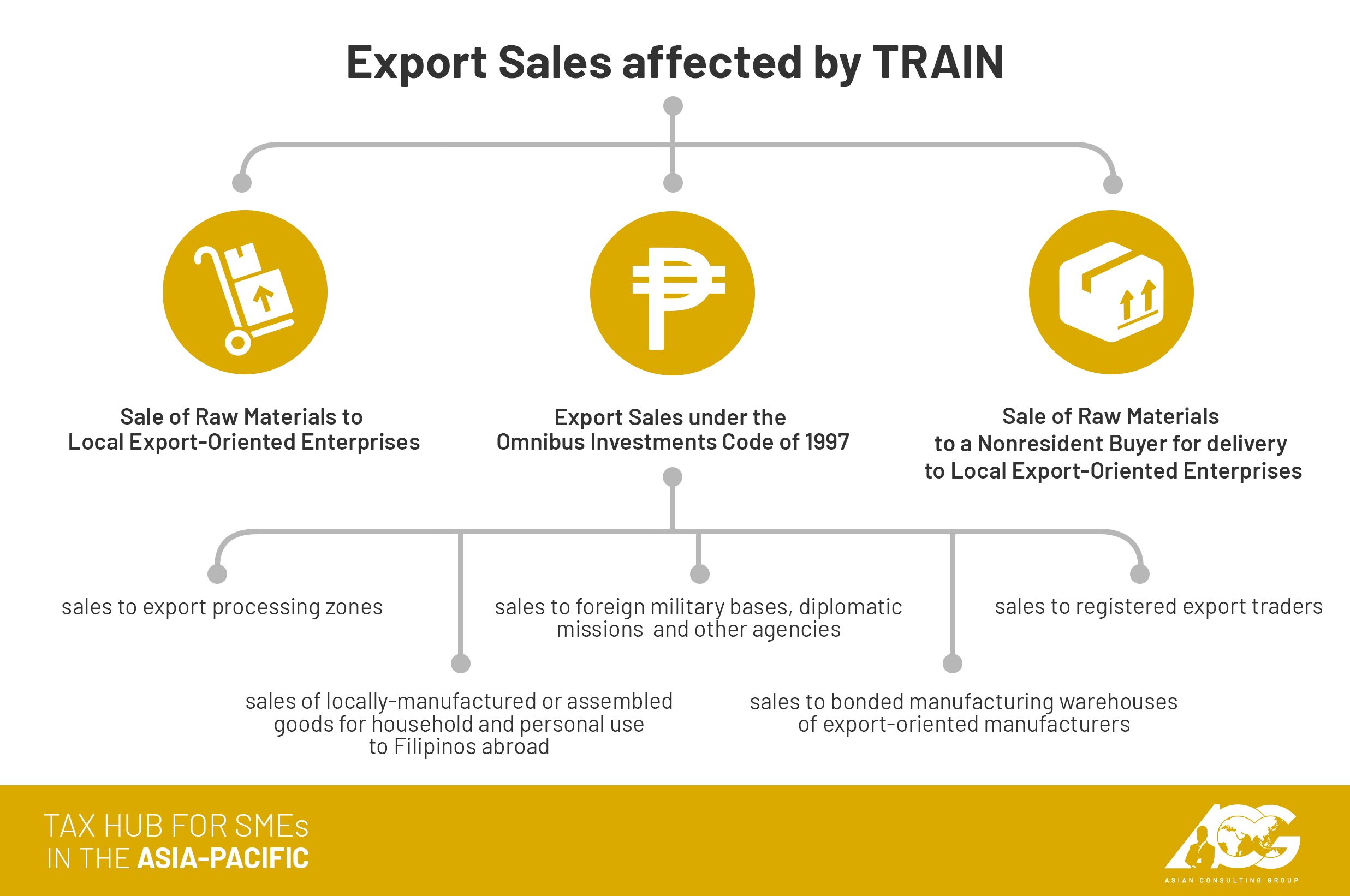

Some types of sales which are currently zero-rated will be considered export sales subject to 12% VAT upon the establishment of an enhanced VAT refund system.

The affected export sales are:

What is the difference between zero-rated sales and VAT exemption?

VAT-exempt taxpayers or those not VAT-registered are not eligible to claim input VAT. However, for zero-rated sales, they are. Under Section 112 of the Tax Code, taxpayers with zero-rated sales may apply for the issuance of a tax credit certificate within two years after the close of the taxable quarter.

Under the TRAIN law, the application for refund of input taxes should be granted by the Bureau of Internal Revenue (BIR) within 90 days. In case the claim is denied partially or in full, the taxpayer may raise the case to the Court of Tax Appeals within 30 days.

If the BIR does not grant the application within the 90-day period, the involved BIR agent will be punished by a fine of P50,000 to P100,000 and imprisonment of 10 to 15 years.

Learning the due process that the BIR must follow can relieve taxpayers of unnecessary expenses. This is especially true for the notoriously expensive BIR audit. In fact, there are several instances – as proven in the Court of Tax Appeals and the Supreme Court – where the BIR audit can be invalidated.

The Asian Consulting Group’s Executive Tax Briefing presents taxpayers with ways they can prepare for the BIR audit and avoid penalties.

As part of its vision as a Tax Hub, ACG is open to all taxpayers for consultations, tax coaching, and tax seminars. To learn more about the Executive Tax Briefing, interested taxpayers may email consult@acg.ph or call (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.