SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I’m a business owner in Quezon City and I noticed that I need to pay my business taxes before I can renew my permit. How can I pay this local business tax?

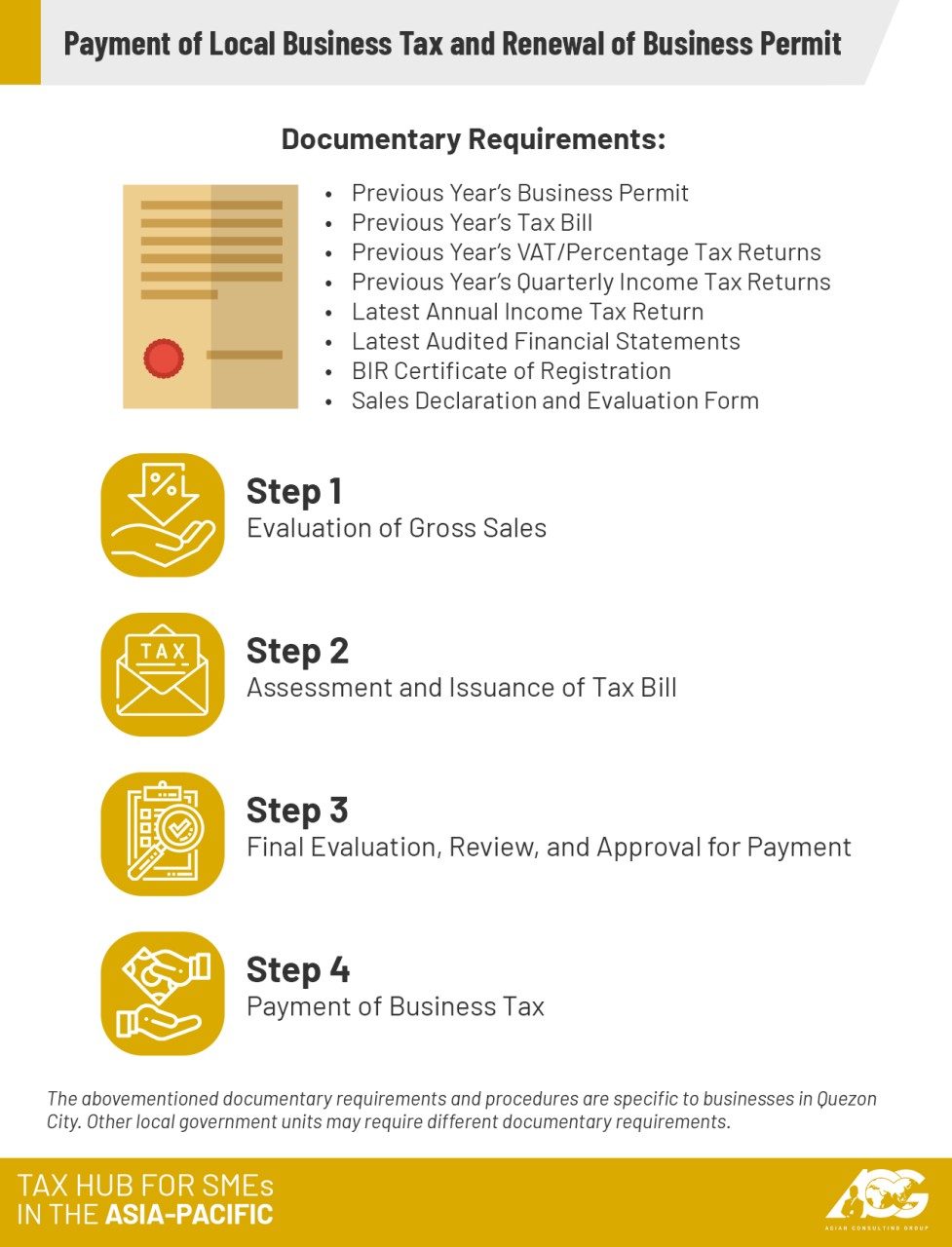

In Quezon City, you first need to fill out the Sales Declaration and Evaluation Form. To support the information you provided, you will need to submit documentary requirements such as the previous year’s business permit, tax bill, value-added tax (VAT) returns, and quarterly income tax returns. You will also need to present your latest annual income tax return along with the complete set of your latest audited financial statements.

Lastly, you will be required to submit your Bureau of Internal Revenue (BIR) certificate of registration.

After providing the documentary requirements, the examiners will evaluate your gross sales and indicate it at the bottom of the sales declaration and evaluation form.

Once done, you will submit the stamped sales declaration and evaluation form for assessment, and then wait for the issuance of your tax bill.

The tax bill will contain the amount of taxes you need to pay, including but not limited to the fire safety inspection fee, community tax, and application fee.

After I’ve paid the tax, what are the next steps in renewing my business permit? Are these requirements the same for everyone else?

Once you’ve paid the business tax, you need to go to the Business One-Stop Shop and submit the following requirements:

- previous year’s business permit

- official receipt of business tax paid

- previous year’s barangay clearance, updated clearances, and permits

- lessor’s business permit (if rented) or title to property/tax declaration (if owned)

- valid locational clearance

- valid fire safety inspection clearance (FSIC)

- valid sanitary permit

- certificate of electrical inspection

- other documents per nature of business

Once done, simply get your claim stub and pick up your renewed business permit on the specified date.

Keep in mind that these steps – both for payment of local business tax and renewal of permit – are for businesses in Quezon City. Other cities may have different requirements, and it will be better to check with your local government unit.

When you’re just starting a business, all these can be confusing – especially once national revenue taxes are taken into account. As mistakes are costly, business owners must take precautions by learning about taxes and attending seminars, consultations, or briefing sessions.

For more tax-related questions, you can reach us here. You can also contact us at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.