SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The government said a weak peso would lift exports. It did not. The government said it is aggressively pushing infrastructure projects and could lift imports. It did not.

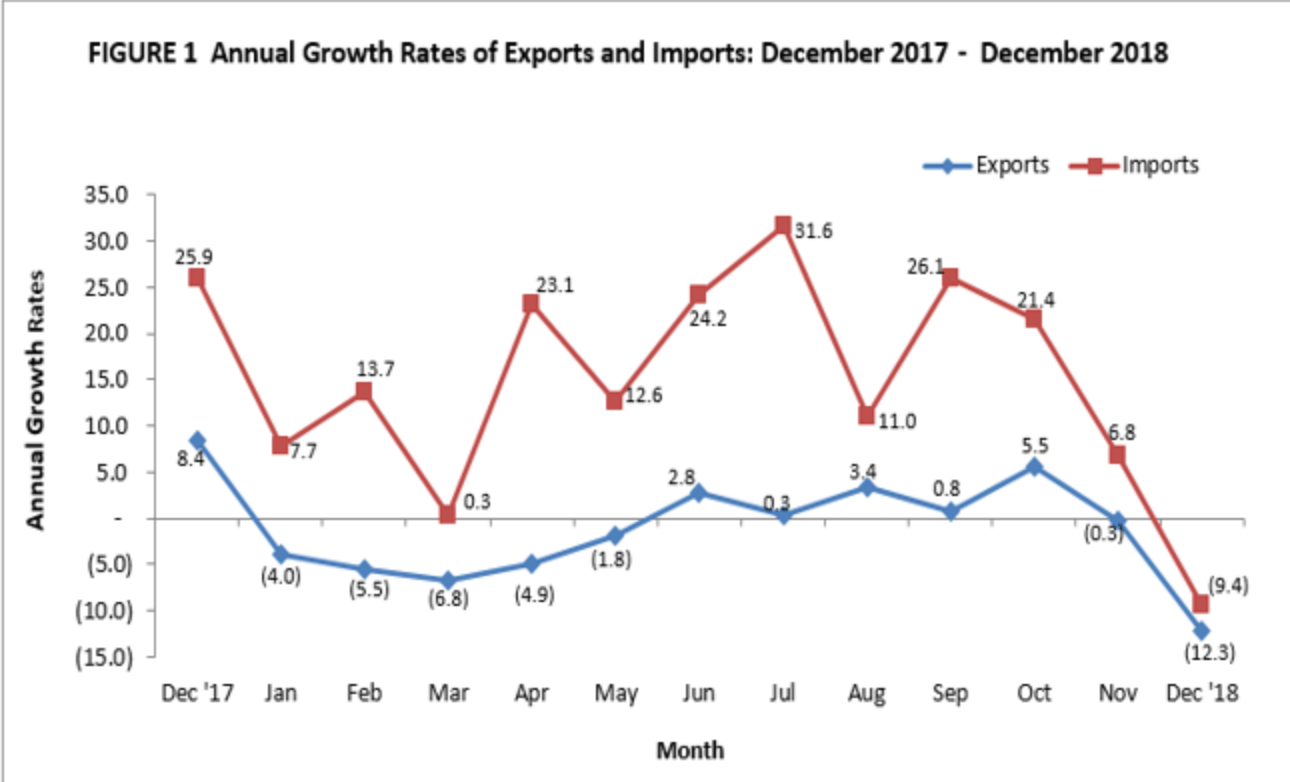

Some of the government’s economic assumptions seemed to have been shaken up in December 2018, with exports posting only $4.7 billion or a negative growth rate of -12.3% year-on-year, said the Philippine Statistics Authority (PSA) on Tuesday, February 12.

This is the slowest export growth since March 2016.

Meanwhile, imports were also in the red, posting only $8.5 billion or a growth rate of -9.4% in December 2018 compared to the same month in 2017.

The negative import growth is the slowest since April 2012.

The last time both imports and exports shrunk at the same time was in February 2016.

For the entire 2018, exports declined to $67.5 billion, 1.8% lower compared to the 2017 figure.

On the other hand, imports climbed to $108.9 billion, 13.4% higher year-on-year.

The overall figures brought the trade gap to a whopping $41.4 billion, the widest ever in Philippine history, according to National Statistician Lisa Grace Bersales.

What it means

Weak exports – Bringing the country’s locally-produced goods to other countries boosts the economy. A weak peso theoretically entices other countries to buy Philippine goods, as they may buy them at a cheaper cost.

However, this did not happen despite the peso trading against the United States dollar at P52 to P54 levels last year.

“Despite the continued weakening of the peso, export performance has not gained the so-called competitive edge that we had hoped it would derive from a weaker currency,” said Nicholas Mapa, senior economist of think tank ING.

The country’s exports are driven mainly by electronics, which saw a slump last December. Mapa said the trade war between China and the US will hurt the sector even more.

“Exports are seen to remain lackluster given the dependence on the electronics sector to carry the entire export base, all the more given the external environment and the US-China trade war,” Mapa said.

Weak imports – The government’s ambitious infrastructure push would mean more imports of steel and raw materials.

While imports increased overall in 2018, it saw a dip in December. The pullback was observed in capital goods and raw materials.

Mapa said the slowdown could indicate that the tightening of monetary policy by the Bangko Sentral ng Pilipinas is “starting to bite into investment appetite, hampering the nascent investment-driven growth story that we have witnessed of late.”

Higher interest rates stifle demand for investment.

Trade gap – When imports exceed a country’s exports, a trade deficit or gap occurs.

A wide trade gap weakens the country’s currency, affects interest rates, and may result in fewer jobs.

“Overall, the trade gap will remain relatively wide in 2019, which could continue to exert a weakening bias on the peso throughout the year,” Mapa said.

Moreover, a persistent trade gap would hurt economic growth.

The country’s gross domestic product grew by 6.2% in 2018, missing the revised target of 6.5% to 6.9%.

What can be done?

Socioeconomic Planning Secretary Ernesto Pernia recommended legislative reforms that would open up sectors for foreign investment to improve the country’s trade numbers and mitigate the impact of the US-China trade war.

Pernia proposed amendments to the foreign investment, retail trade, and public services law.

“We should encourage foreign firms to transfer their manufacturing facilities [to] the Philippines and to take advantage of the growing domestic market,” he said.

Pernia once again pushed for the full implementation of the Ease of Doing Business Act to eliminate bureaucratic and regulatory barriers that raise the cost of doing business in the country.

To date, the government has yet to set implementing rules and regulations for that law. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.