SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The government boasted that the “golden age” of infrastructure is coming. Private firms echoed the same thing.

But while some big-ticket projects under the Build, Build, Build program have started construction, most are still under negotiations. (READ: Made in China: Loan terms with waivers, shrouded in secrecy)

The budget impasse also caused infrastructure spending to fall by 5.7% in April and led to the dismal slump of the gross domestic product to just 5.6% in the 1st quarter of 2019.

Despite the hiccups, First Metro‘s Cristina Ulang is optimistic that projects and infrastructure spending will be boosted in the coming months, which would also be good for infrastructure stocks.

Here are two of her picks:

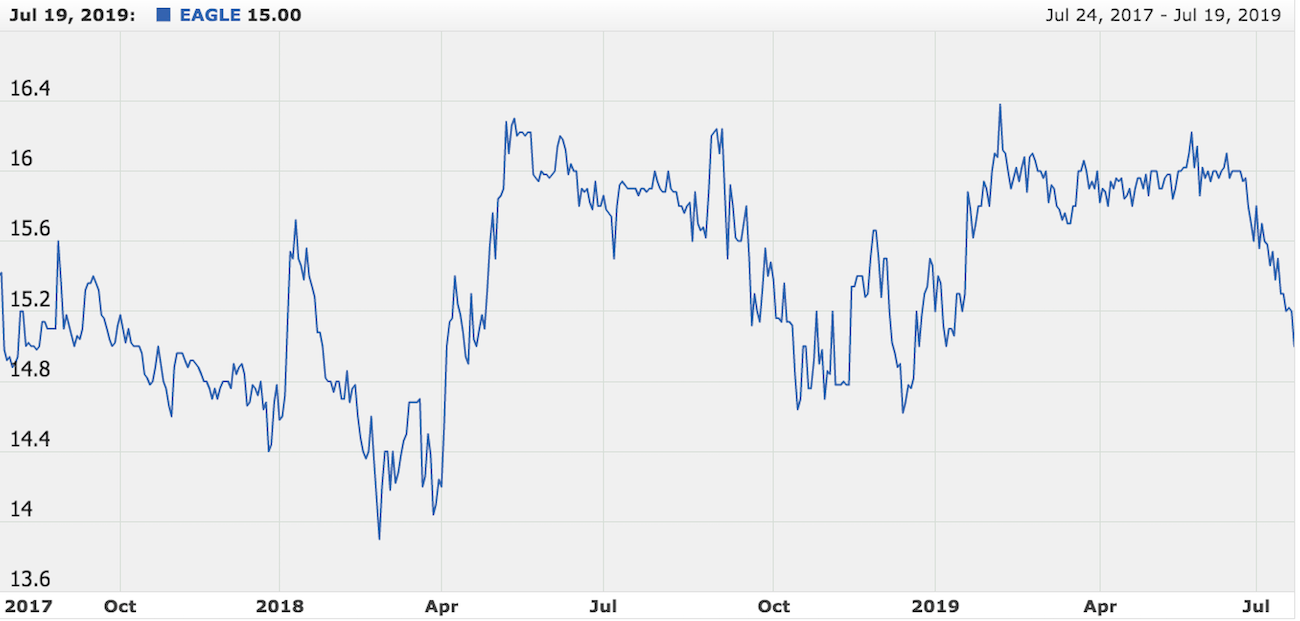

Eagle Cement (EAGLE)

Target price: P20 per share

Ramon Ang‘s Eagle isn’t quite soaring to the skies yet. In fact, stock prices have been falling since June.

Ulang admitted that Eagle has been “sluggish,” but also said that Eagle boasts an expansion story that investors need to take a closer look at.

“It is also one of the most profitable among cement stocks in terms of EBITDA (earnings before interest, tax, depreciation, and amortization) margin,” she said.

Eagle generated net sales of P16.5 billion for 2018, 11% higher year-on-year due to double-digit sales volume growth.

It has allotted P3.28 billion in capital expenditures for 2019, the bulk of which will be used to finish its 5th mill as part of its expansion program.

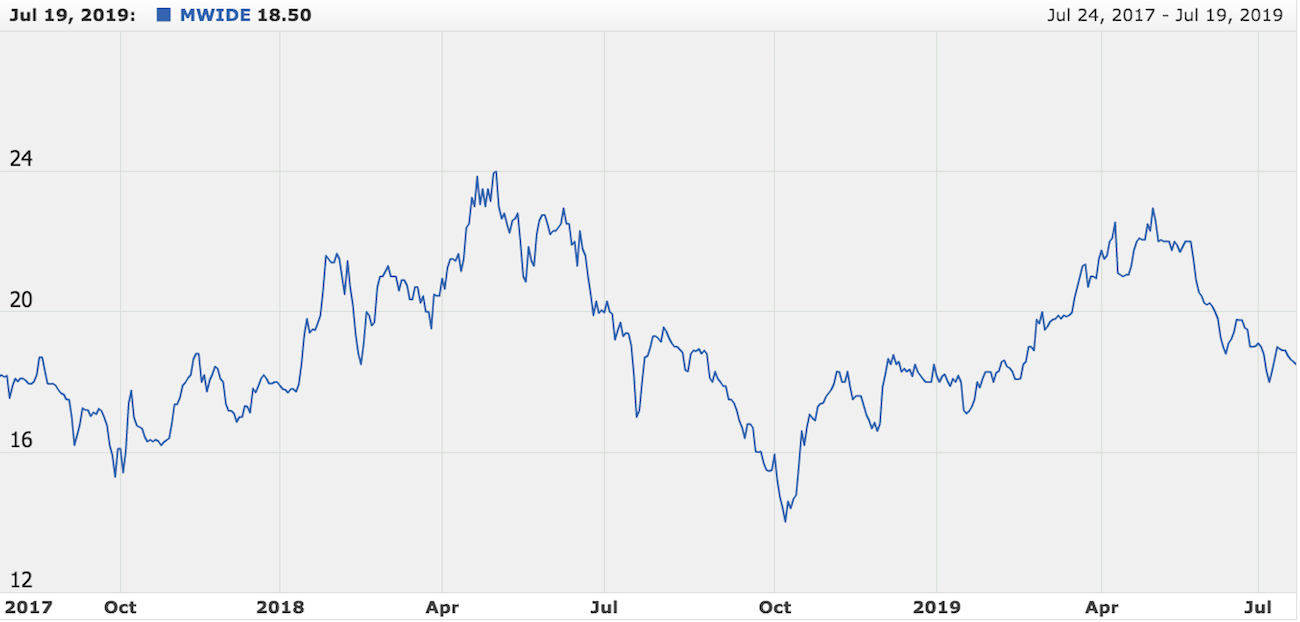

Megawide (MWIDE)

Target price: P24 per share

Ulang is also betting on diversified engineering and infrastructure conglomerate Megawide, though it struggled in 2018.

Its net income stood at P1.8 billion last year, 20% lower than the P2.25 billion it reported in 2017, with earnings from the construction business declining by 30% to P763 million.

Ulang said Megawide still has plenty of room to grow.

It operates the Mactan-Cebu International Airport with Bangalore-based GMR, and is feisty enough to battle against the country’s biggest conglomerates for the rehabilitation and redevelopment of the Ninoy Aquino International Airport.

It is also part of the consortium constructing Maynilad’s Las Piñas Water Reclamation Facility, which is the largest wastewater treatment plant in Metro Manila’s West Zone. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.