SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

AT A GLANCE:

- Inflation reaches a 9-year high of 6.7%

- Oil and rice prices soar, revealing the soft spots of the Philippine economy

- Duterte’s economic team and government agencies scramble to restrain prices of goods, while playing the blame game

MANILA, Philippines – High prices of goods shocked Filipinos this year, as inflation soared to a high of 6.7%.

It’s been almost a decade since the Philippines last experienced high inflation. It spoiled economic growth, contributed to the bleeding of the stock market, and messed up the budget of the poorest Filipino families.

While inflation has started to ease and is expected to fall in 2019, this year’s experience revealed cracks in governance and policy that the country’s economic managers need to patch.

Economists further argued that problems in governance mixed with global forces was a recipe for disaster.

Runaway TRAIN, sluggish drivers

The Duterte administration kicked off 2018 with the Tax Reform for Acceleration and Inclusion (TRAIN) law, slapping higher taxes for oil, tobacco, and sugary drinks.

The upside was the tax exemption for workers earning up to P250,000 a year from paying taxes.

TRAIN law, as well as other pending tax reform packages, aim to collect over P181 billion to support the government’s Build, Build, Build program and ignite the so-called “golden age of infrastructure.”

Duterte’s economic team assured legislators that inflation would fall within the target range of just 2% to 4% despite the new taxes.

‘Tax policy is difficult to get right, and the models used to estimate its impacts must be more grounded and transparent.’

– JC Punongbayan, Rappler columnist

They also placed safety nets such as unconditional cash transfers and fuel cards to shield the poorest Filipino families from inflation.

However, months passed and the economic team admitted they did not anticipate the spike. Worse, the distribution of cash assistance was sluggish.

The Department of Social Welfare and Development (DSWD) said they were only able to disburse all funds in September, when inflation had already peaked.

The Department of Transportation (DOTr) also faced delays in distributing some 179,000 fuel cards worth over P20,000.

“The lesson is that tax policy is difficult to get right, and the models used to estimate its impacts must be more grounded and transparent and must take into account people’s expectations and the logistical realities of distributing cash transfers,” Rappler columnist and economist JC Punongbayan said.

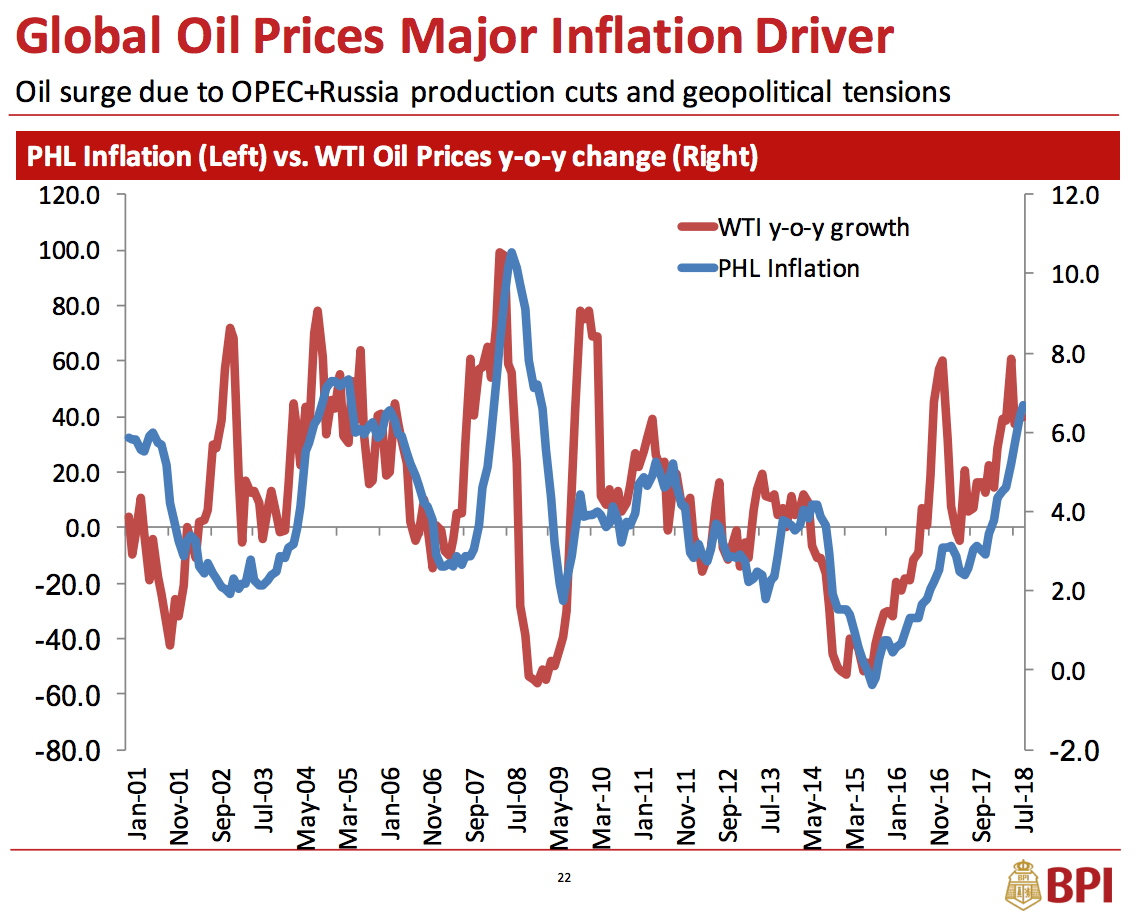

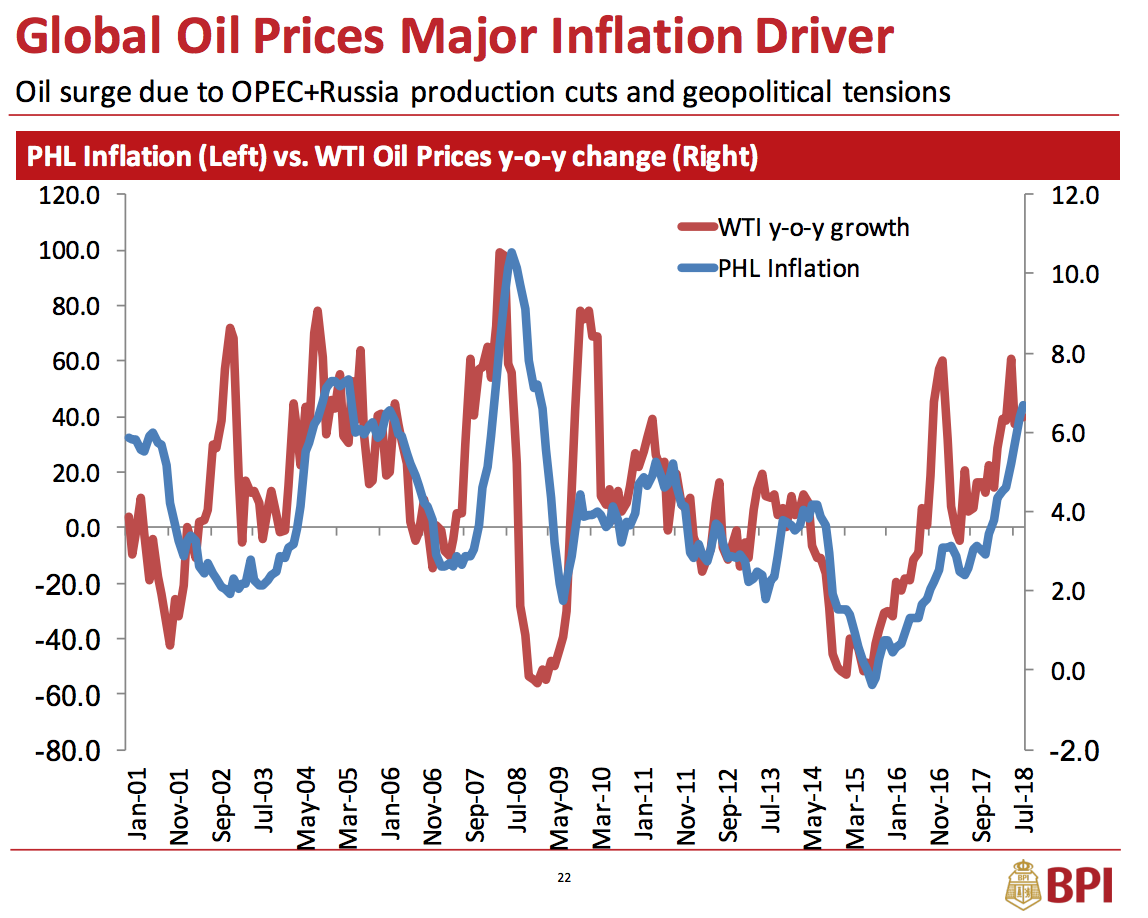

Volatile oil

The new taxes came at a time when oil prices in the world rose due to geopolitical conflict.

The TRAIN law raised levy on gasoline to P7 per liter and slapped an additional P2.50 per liter on diesel in 2018.

The law also stated that diesel and gasoline prices would rise again in 2019 by P2 per liter, and P1.50 per liter in 2020.

The Philippines is highly dependent on oil imports, producing only 7.5% of its total oil requirements. This makes the country extremely sensitive to global forces.

Dubai crude oil reached as high as $76 per barrel in 2018. During the deliberation of the TRAIN law, prices were only around $50 a barrel.

Consumer groups appealed to government to suspend the taxes on oil, but Department of Budget and Management (DBM) Secretary Benjamin Diokno said that the law is clear that they cannot backpedal.

“Remember, we had $135 per barrel under GMA (Gloria Macapagal Arroyo), so I think we should be less of a crybaby,” Diokno said last May 30.

The law will only suspend succeeding hikes once global oil prices breach $80 per barrel, but cannot take back what had been implemented the year before. (READ: Duterte approves 2019 fuel tax hike)

Tax expert Mon Abrea urged legislators to revisit the mechanisms to control prices.

“That provision on fuel tax suspension should be repealed because we cannot just base it on Dubai crude oil. Inflation rate should be taken into account,” Abrea said.

While legislators assured Filipinos they would look into the matter, come end-2018, reelectionists have already distanced themselves from it.

Rice mismanagement

Alongside oil, rice prices also soared in 2018, mainly due to the power struggle and mismanagement within the National Food Authority (NFA).

In April, the NFA said that the Philippines’ rice buffer stock had been wiped out, which Diokno called “incompetence.” (READ: Rice prices soar as Duterte marks 2nd year in office)

“With the elections coming, I don’t think they will make the same mistake with the NFA in the coming months,” BPI chief economist Jun Neri said.

The rise of rice prices also exposed the major problems in the agriculture sector: dependence on imports and the poor state of farming in the country.

‘Farmers never had it so good until today.’

– Agriculture Secretary Emmanuel Piñol on high rice prices

The NFA buys rice from Thailand and Vietnam and not from Filipino farmers, since their regional counterparts can produce rice at a much cheaper cost. This renewed calls to improve the state of farming in the country.

Rubbing salt in the wound, Agriculture Secretary Emmanuel Piñol even insisted that high rice prices was a “win” for farmers.

“Ano ba naman itong P5 na pagtaas ng presyo sa bigas? (What is an increase of P5 for the price of rice?) Let’s look at it as helping the farmers,” Piñol said.

The worst hit was the Zamboanga-Basilan area, where rice prices skyrocketed to P70 per kilo.

Piñol went on to recommend setting up a trading center in the area, somewhat “legalizing” smuggled rice from Malaysia. (READ: Piñol wants to legalize smuggled rice in Zamboanga-Basilan area)

Duterte was amenable to the idea and went on to issue an executive order institutionalizing barter trade in Mindanao.

Duterte is also set to sign the rice tariffication bill into law, which, according to Socioeconomic Planning Secretary Ernesto Pernia, would bring rice prices down by P7 per kilo. Critics, however, warn that local farmers will have a hard time competing with imports.

PR nightmare

High inflation dented the government’s image and highlighted Duterte’s indifference to managing the economy.

“‘Yun ba namang inflation na ‘yan, kapag sa mga utak na ‘yan hindi talaga, eh hindi talaga kaya eh. Wala tayong magawa,” Duterte said.

(If experts cannot fix inflation, it cannot be done. There is nothing we can do.)

Bloomberg called the situation an “inflation crisis,” while an Inquirer column said high prices were a “powerful destabilizer.”

‘Alam mo, sa tingin ko kung masipag ka lang, hindi ka magugutom sa Pilipinas. Kung masipag ka lang.’

– Budget Secretary Benjamin Diokno on high inflation

Business reporters have been running out of alternative words for “rise,” “soar,” or “jump.”

Pernia even joked on a couple of occasions to be “gentle” with questions whenever a new inflation figure would be released.

Meanwhile, Diokno and Finance Secretary Carlos Dominguez III repeatedly said that the country experienced higher inflation in the past.

The DOF even went on to publish a graph, showing that inflation under Duterte was lower compared to past administrations.

Former DOF undersecretary Sunny Sevilla slammed his former agency for posting a “tone-deaf” and “misleading” graph showing inflation in the Philippines over the last 30 years.

When inflation started to reach over 5% mid-year, the economic team eventually stopped pronouncements like, “Let’s just tighten our belts.”

‘Since it’s already there, let’s live with it. It’s a short-term pain for a long-term gain.’

– Socioeconomic Planning Secretary Ernesto Pernia on high inflation

Through joint statements, they said they now “understand” the public sentiment and are doing their best to address the problem.

Call for action

What’s to learn from this year’s experience?

Abrea emphasized that government failed to look beyond taxes and pointed out the most basic virtue: good governance.

“If we have addressed inefficiency, we don’t even need new taxes. If only they were efficient and honest and addressed smuggling and corruption,” he said.

Abrea proposed going as far as abolishing the Bureau of Internal Revenue (BIR), install competent personnel, and raise their salaries. He said doing so would result in better tax collection, a wider tax base, and less corruption.

Meanwhile, Punongbayan proposed that government suspend implementing the 2nd tranche of fuel excise taxes, even though global prices are projected to decrease.

“New taxes should only be implemented if inflation falls within 2% to 4%,” he said.

To shield the poorest Filipinos from rising oil prices, Neri said that government should also look into imposing fuel subsidies like what’s being done in Malaysia and India.

As for rice prices, Montesa said that rice tariffication is just the first step, as the staple is a “highly politicized crop.”

“Addressing government inefficiency and corruption ought to be a given,” Montesa added.

While most experts project that inflation won’t hurt as much in 2019, knee-jerk responses and blame games might just trigger another round of price hikes. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.